Better Know the Money Game - Before It Plays You

How macro moves can vaporise valuations, crush runways, and why founders who understand the rules win.

I wish I’d understood the big-picture money game when we bootstrapped our first company, Beecom, back in 2000. Whenever markets sneeze, startups catch pneumonia - and the founders who grasp the rules pull ahead while everyone else is praying the term-sheet gods stay kind. That’s why I’m writing this summary: to give you the macro cheat-sheet we never had.

I was born in 1970 and grew up between scaffolding and the smell of fresh concrete. My dad was a site-manager architect — the on-site boss who coordinated every trade on a construction project. His “office” was a wooden barrack tucked beside the crane tower, and weekend inspections felt like the greatest adventure.

In the late ’70s, Fed chair Volcker drove the federal-funds rate above 15% to crush double-digit inflation. This spike in interest rates froze new builds and my father’s projects were mothballed overnight. We packed, moved, and he scraped together whatever work he could find until the industry finally recovered.

Back then I couldn’t spell “inflation,” let alone grasp how policymakers thousands of kilometres away could decide whether my dad ran a construction crew or sold iron fittings. Fast-forward to today’s showdown between President Trump and Fed chair Jay Powell and the déjà-vu is hard to miss: different protagonists, same stakes. When politics leans on the central bank, real jobs disappear first — and startup runways follow close behind.

1. It’s Getting Personal at the Fed

What just happened: On Monday (Apr 21) President Trump jumped onto Truth Social, labelled Fed chair Jay Powell “Mr Too Late”1 and demanded an instant rate cut. Within hours:

S&P 500 -2.4 %, Nasdaq -2.6 % — roughly $1 trn in US market cap gone.2

Dollar index sank to a 3-year low; gold printed yet another record.

Safe-haven flows accelerated out of Treasuries (most likely into gold and 🇨🇭Swiss Franc), pushing the 10-year yield above 4.4 %.3

By yesterday night Trump tried to calm things, telling reporters he had “no plans to fire Powell— I just want lower rates.” Markets bounced, but the damage to credibility was done. Only five days earlier he’d posted that “Powell’s termination can’t come fast enough!” and insiders leaked that he’d already sounded out possible replacements. The rapid U-turn reinforces Wall Street’s core worry: policy coming via social-media mood swings instead of a stable playbook.45

Why the clash? (Quick primer for non-econ folks)

Rates are high: The Fed’s policy band sits at 4.25 – 4.50 %, held there to make sure post-COVID inflation keeps drifting toward 2 %.

Tariffs are inflationary: Trump’s 2025 “Liberation Day” levies risk adding 1-1.5 pp to core CPI, so Powell is reluctant to cut pre-emptively.6

Politics meets independence: Markets fear a precedent: if a president can intimidate the Fed, long-term inflation expectations jump and yields follow … and the USD loose even more traction.

Senator John Kennedy (Louisiana) — hardly a Powell fan — still told NBC the chair has “tiger blood” and that no president can simply sack him. The comment landed precisely because a chunk of Wall Street was beginning to price in the attempt.7

Can Trump really fire Powell?

Law: The Federal Reserve Act says governors can be removed only “for cause.”

Precedent: The 1935 Humphrey’s Executor ruling shields independent-agency heads from at-will dismissal. Legal scholars say that guard-rail still applies.8

Work-around risk: Trump could demote Powell from chair (4-year term) but Powell would remain a voting governor until 2028, and policy is set by 18 officials, not one.

Bottom line: Even the threat erodes credibility; a forced exit could turn the current dollar slide into a rout.

Why founders should care (translate to runway language)

Valuations shrink when risk-free yields jump. A 30 bp rise in the 10-year can shave 10-15 % off SaaS multiples.9

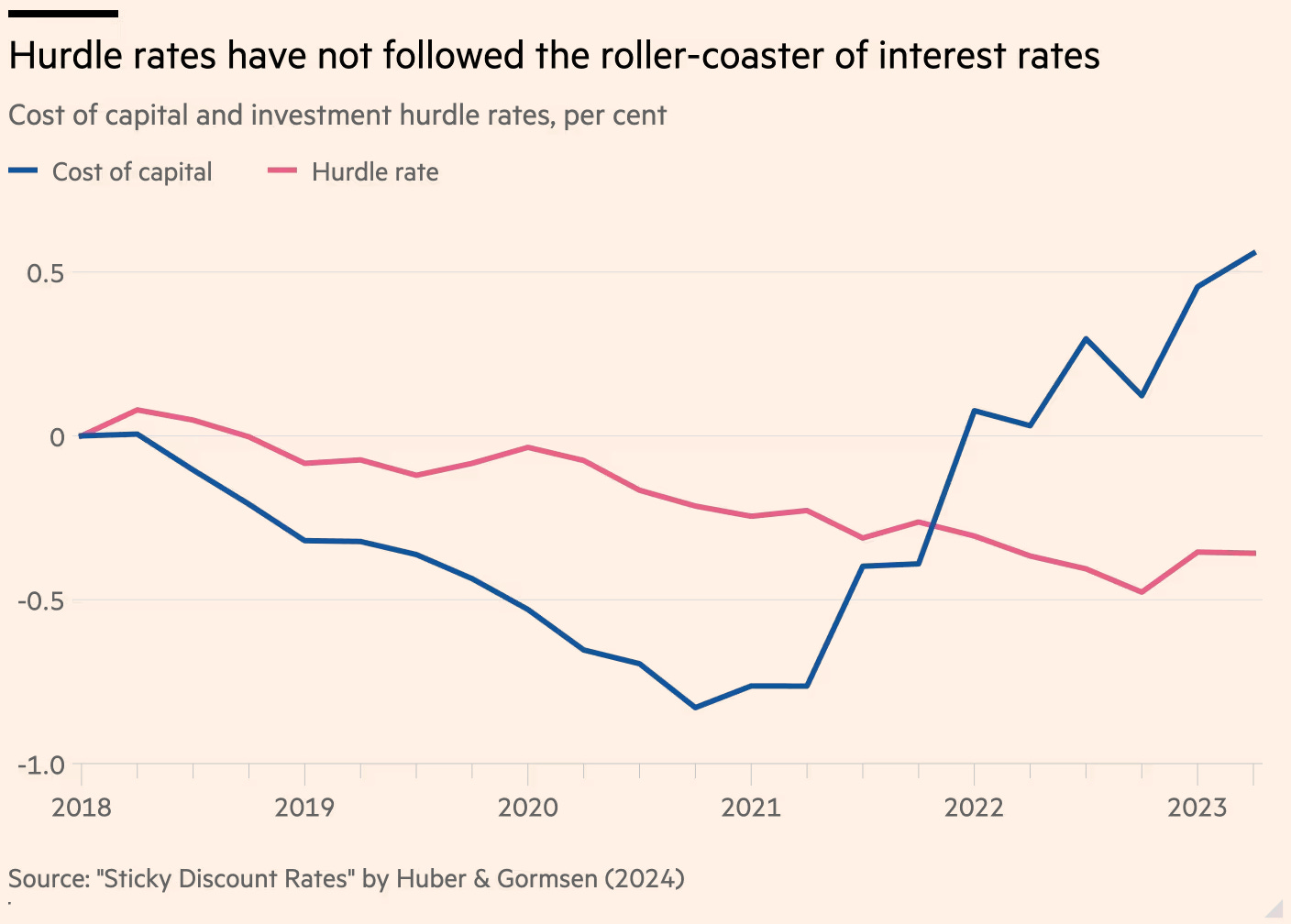

Funding windows get skittish. In 48 h this week some growth funds widened their hurdle IRRs by 100 bp — that alone can drop Series A cheque sizes.10

FX volatility eats margin. Billing in USD but paying teams in EUR/CHF? A 5 % dollar swing moves your cost base more than most seed-stage gross margins.11

Action prompts

Stress-test your cash runway at Fed-Funds 5 %.

Re-quote any multi-year SaaS contracts in local currencies where feasible.

Keep an eye on the May 1 FOMC: even a token 25 bp cut would likely re-open the risk-on window for Q3 raises.

2. How the Dollar Became King

Before we can judge whether today’s Trump-Powell drama might knock the greenback off its pedestal, we need to see how the pedestal was built. Three inflection points did most of the heavy lifting: the Bretton Woods gold peg, the petrodollar deal, and the Plaza-Accord devaluation. Each solved the same problem in a different era—how to keep the world settling bills in dollars even when the fundamentals shift. Let’s rewind through those moves, then loop back to what they mean for founders staring at term sheets in 2025.

2.1 Bretton Woods: Gold at $35 an Ounce

Why it matters: This pact hard‑wired the dollar into the post‑war financial plumbing, giving it the credibility startups still tap when they raise USD rounds.

Jul 1–22 1944: 730 delegates from 44 nations map out a gold‑backed dollar system at Bretton Woods, NH.

Architecture: Currencies peg to USD ±1 %; Washington redeems at $35/oz.

Edge: The U.S. owns ~⅔ of global gold and half of world GDP - no other country can contest the peg.

Erosion: By 1971 wars + welfare burn reserves; Fort Knox falls from 20 000 t to 9 000 t.12

Takeaway: The brand value of “dollar = solid” began here; eroding that brand (through politicised rate policy) can raise founders’ cost of capital overnight.

2.2 1971: The Nixon Shock

Why it matters: It proved the U.S. can change the rules - and the world will still play along - so long as the underlying market depth remains.

Aug 15, 1971: Nixon shuts the gold window, slaps a 10 % import surcharge, and freezes wages/prices.

Smithsonian patch: Wider bands collapse; by Mar 1973 major currencies float freely.

Birth of modern FX: Daily turnover jumps from <$10 bn in 1970s to >$7 trn by 2020.

Dollar survives: Investors choose liquid U.S. markets over metal backing.13

Takeaway: Even fiat survives if institutions are trusted - rattle the Fed’s independence and that trust premium shrinks.

2.3 1974: Enter the Petrodollar

Why it matters: Pricing oil in USD created a floor of forced global demand, recycling energy profits back into Treasuries—keeping U.S. rates lower than growth alone would justify.14

1973 oil shock: Crude prices quadruple, importers scramble for dollars - setting off the chain reaction that would stall my dad’s construction jobs a few years later.

1974 U.S.–Saudi deal: Oil priced exclusively in USD; Saudi surpluses funnel into U.S. bonds.

Network lock‑in: By 1976 all OPEC members invoice in USD; energy trade cements dollar primacy.

Eurodollar boom: Offshore dollar lending explodes, powering global trade finance.

Takeaway: A cheap dollar credit pipeline is part of every SaaS founder’s run‑way - weakening it means higher USD hedging and debt costs.

2.4 1985‑87: The Plaza Accord and a 50 % Dollar Dive

Why it matters: Shows that when imbalances build, allies can and will coordinate to nudge the dollar - policy, not gold, is now the lever.15

Mid‑1985: Dollar up ~46 % vs. G‑10 on Volcker’s 20 % rates + Reagan deficits.

Sep 22, 1985: G‑5 meet at Plaza Hotel, vow joint FX intervention.

Result: Dollar falls ~50 % vs. yen & DM by early 1987; Louvre Accord then stabilises.

Lesson: Credibility endures coordinated corrections; unilateral meddling spooks markets.

Takeaway: If Trump forces a Fed capitulation alone, expect a Plaza‑in‑reverse - disorderly dollar slide, funding turbulence, and compressed exit multiples.

Big picture: From gold, to oil, to coordinated diplomacy, the dollar’s crown sits on institutional trust. Undermine those institutions and founders everywhere feel it first in their term sheets.

3. Why Central‑Bank Independence Matters (and Why Startups Should Care)

The Fed’s arm’s‑length status isn’t a polite tradition - it’s a price‑stability machine. IMF research finds countries with strong central‑bank independence run lower, less volatile inflation and achieve steadier growth.16

In US law, that firewall is buttressed by the 1935 Humphrey’s Executor precedent, which says independent‑agency heads can’t be removed over policy disagreements. If the Supreme Court chips away at that shield in the coming months, every founder should expect a risk‑premium jump in funding costs as investors re‑price US assets.

4. Trump vs Powell: What’s Really at Stake

If the president forces a leadership change, markets will fear a politicised Fed that prints to fund deficits and tariffs - classic recipe for higher long‑run inflation.

5. Ripple Effects for Early‑Stage Startups

Cost of Capital: A credible, independent Fed keeps US risk‑free rates anchored. Undermined credibility → higher yields → venture valuations compress.17

FX Volatility: A disorderly dollar slide raises hedging costs for SaaS firms billing globally.18

Exit Windows: Risk‑off equity markets delay IPOs and tighten M&A multiples.

Pricing Power: Tariff‑driven input inflation squeezes margins unless founders can pass costs on.19

Playbook: extend runway, diversify funding (EUR, CHF, AED lines), lock in term sheets, and stress‑test pricing models for a 200 bp rate shock.

6. Key Takeaways

The dollar’s reserve‑currency status was built on institutions, not tweets.

History shows it can wobble - gold exit, petrodollars, Plaza Accord - but network effects keep bringing capital back.

An independent central bank is the silent backbone of that trust. Politicise it and the privilege can erode faster than founders can raise their next round.

Bottom line: Watch the Trump‑Powell soap opera not as political theatre, but as a live‑fire stress test of the world’s hinge currency - and your runway.

Done. Don’t just think. Drop a comment below or email me directly if you have questions or remarks. More than happy to answer: fabian@studioalpha.capital.

Let’s be patient, keep working hard and stay confident. It will pay off.

Fab 🦔

Sources

https://www.foxbusiness.com/economy/trump-slams-powell-mr-too-late-calls-fed-chairman-major-loser?utm_source=chatgpt.com

https://www.reuters.com/markets/global-markets-wrapup-1-2025-04-21/

https://www.reuters.com/markets/global-markets-wrapup-1-2025-04-21/?utm_source=chatgpt.com

https://www.bloomberg.com/news/videos/2025-04-22/trump-says-he-doesn-t-plan-to-fire-fed-chair-powell-video?utm_source=chatgpt.com

https://www.reuters.com/world/us/trump-says-fed-chair-powells-termination-cant-come-fast-enough-2025-04-17/?utm_source=chatgpt.com

https://www.reuters.com/business/trump-warns-economic-slowdown-unless-fed-cuts-rates-2025-04-21/?utm_source=chatgpt.com

https://www.ft.com/content/c9964697-eec4-49ce-a989-787cd5762cad?utm_source=chatgpt.com

https://www.reuters.com/legal/government/column-fed-chairs-job-security-depends-embattled-supreme-court-precedent-2024-11-11/?utm_source=chatgpt.com

https://www.morganstanley.com/im/publication/insights/articles/article_growthvsvalue.pdf?utm_source=chatgpt.com

https://www.ft.com/content/65b0976c-3bc9-4305-ba8a-5ab2cec22d62?utm_source=chatgpt.com

https://stripe.com/en-jp/resources/more/cross-border-businesses-explained-what-they-are-and-how-they-work?utm_source=chatgpt.com

https://www.federalreservehistory.org/essays/bretton-woods-created?utm_source=chatgpt.com

https://www.federalreservehistory.org/essays/gold-convertibility-ends?utm_source=chatgpt.com

https://www.investopedia.com/terms/p/petrodollars.asp?utm_source=chatgpt.com

https://www.investopedia.com/terms/p/plaza-accord.asp?utm_source=chatgpt.com

https://www.imf.org/en/Blogs/Articles/2024/03/21/strengthen-central-bank-independence-to-protect-the-world-economy

https://www.ft.com/content/d47218f0-6612-41bc-9137-25f19a3d2c4a?utm_source=chatgpt.com

https://www.reuters.com/markets/wealth/global-markets-dollar-hedging-analysis-pix-2025-04-11/?utm_source=chatgpt.com

file:///Users/fabianhediger/Downloads/ch1%20(2).pdf