2025: The Year That Decides Who Controls the Future

AI, trade wars, and why entrepreneurs must choose sides now.

Imagine you're Nvidia’s founder & CEO Jensen Huang. You’re crushing it in AI, investors love you, your chips are powering the future - and suddenly, geopolitics slaps you in the face. The U.S. government bans you from exporting your AI chips to China, wiping out $5.5 billion from your revenue overnight. Welcome to the new reality: geopolitical tensions have just begun reshaping global business.

Clash of the Titans Goes On: Tech in the Crosshairs

The tension between the U.S. and China is escalating dramatically, and at its heart is a fierce battle over AI supremacy. Just yesterday, Nvidia announced a massive USD 500bn investment in U.S.-based AI infrastructure - clearly aligned with President Trump’s policy to bring critical technology home.1 Yet even such huge bets don’t buy immunity: U.S. export controls have targeted Nvidia’s H20 chips - key processors explicitly designed for the Chinese market after their more powerful Blackwell chips were already banned from export to China. These moves underline the strategic stakes and the intensity of the geopolitical showdown in AI.2

According to a recent UBS analysis, Nvidia has around 12-15% of its total revenues exposed to the Chinese market. This might seem moderate compared to competitors like AMD, with 24%, or ASML, which relies on China for 27% of its revenue. However, the stakes for Nvidia remain incredibly high. The H20 chip alone accounts for roughly 6-7% of Nvidia's overall revenue, making it a significant loss - estimated at $5.5 billion - as recent U.S. sanctions bite.3

China remains Nvidia’s second-largest market globally, with massive growth potential in the coming years. The U.S.'s aggressive stance demonstrates how AI technology has become a strategic frontier. Whoever controls AI will significantly influence the future economic and military balance. As the tension escalates, it's clear the U.S. administration is willing to sacrifice short-term economic gains for longer-term strategic dominance.

The broader semiconductor industry also stands at this crossroads, as highlighted by the UBS report. The deep dependency of Chinese tech giants on foreign chips makes the current tension more acute. Without access to advanced Western technologies, China faces severe limitations in developing its own AI-driven infrastructure, giving the U.S. a powerful negotiating lever.

Jamie Dimon’s Warning: Navigating a Fragmented World

In his recent shareholder letter, JPMorgan Chase CEO Jamie Dimon paints a vivid picture of an increasingly fragmented world order shaped by geopolitical uncertainties. Dimon emphasizes the importance of resilient global alliances, especially in technology and trade, to maintain economic stability.

Echoing concerns from the semiconductor conflict, Dimon warns of the broader consequences of U.S.-China decoupling. He strongly advises against an outright separation, suggesting instead a strategic approach that safeguards national security while maintaining essential economic ties. This strategy mirrors the controlled engagement seen in the semiconductor space, where targeted restrictions aim to limit China’s military capabilities without entirely severing commercial ties.

🪙 Planet EU: Where Silk Scarves Outshine Silicon Chips - While the U.S. and China vie for dominance in AI and quantum computing, Europe’s top corporate rivalry centers on goods that are not (yet?) regulated to death. Hermès, famed for its silk scarves, has recently surpassed LVMH, the conglomerate behind Louis Vuitton and Moët Hennessy, to become Europe’s most valuable company with a market capitalization of approximately €248 billion.4

Investors are valuing Hermès at a price-to-earnings (P/E) ratio of 56.4 (😳), significantly higher than LVMH’s P/E of 20.2 . This suggests a market preference for traditional luxury over diversified portfolios. For comparison: P/E Nvidia is 38.2.

In a world racing towards technological advancement, Europe’s economic “The Leader of AI Regulation in the World” focus on luxury goods may reflect a broader challenge in adapting to the demands of the future.5

Dimon’s letter connects explicitly with the tech tensions in highlighting AI as a critical determinant of future economic prosperity and global influence. He underscores that Western nations should build strong alliances to counterbalance China's aggressive technological ambitions. "America First does not mean America alone," he emphasizes, advocating for a coordinated effort with Europe, Japan, Korea, and Australia.6

Opportunities Amidst Chaos: The Startup Advantage Right Now

Behind the dramatic headlines and political showdowns, particularly between the USA and China, there lies something more profound. The escalating trade war, tariffs, and geopolitical tensions are symptoms rather than causes. At the heart of this turbulence is a battle for control over the future’s defining technology - Artificial Intelligence.

This moment can be seen clearly through the lens of Kondratieff7 waves or economic supercycles. Historically, each supercycle - be it steam power, electricity, mass production, or the digital revolution - has fundamentally reshaped the global order, determined new economic leaders, and defined power structures for generations.

Today, we find ourselves at the cusp of another transformative supercycle driven by AI. This is not just about who sells more chips; it’s about who controls the AI that will shape societies, economies, and geopolitics for decades. The current U.S.-China tensions, therefore, are not merely trade disputes. They represent a critical juncture in the historical battle for technological dominance. When our children look back, 2025 might well be remembered as the pivotal year when the next global order was decided.

How Global Trade Dominance Shifted from the U.S. to China

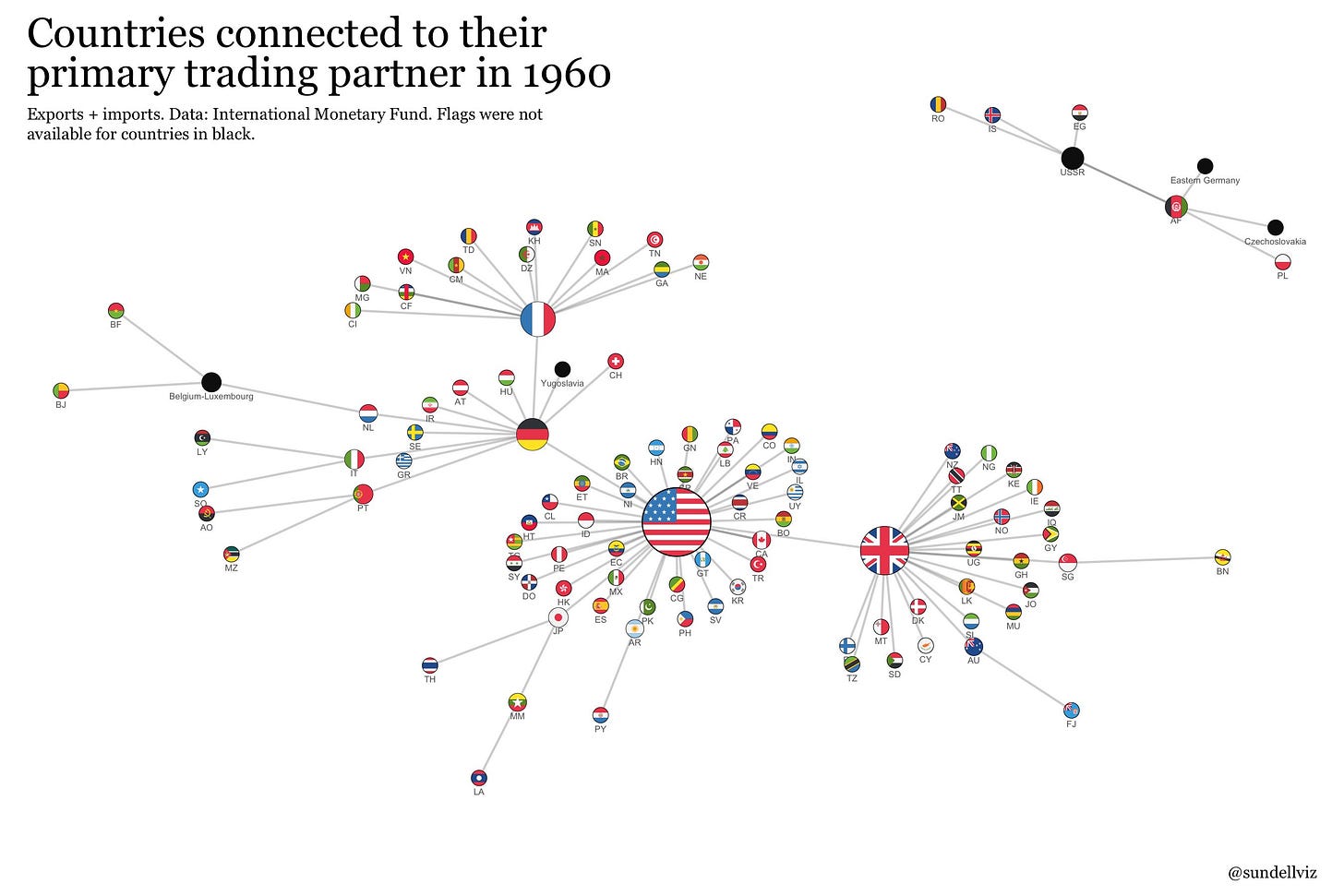

1960 - American Economic Supremacy: In the post-war era, the United States stood undisputed as the center of global trade. Benefiting from domestic economic expansion, technological advancements, and supportive trade policies, America was the primary trading partner for numerous countries globally.

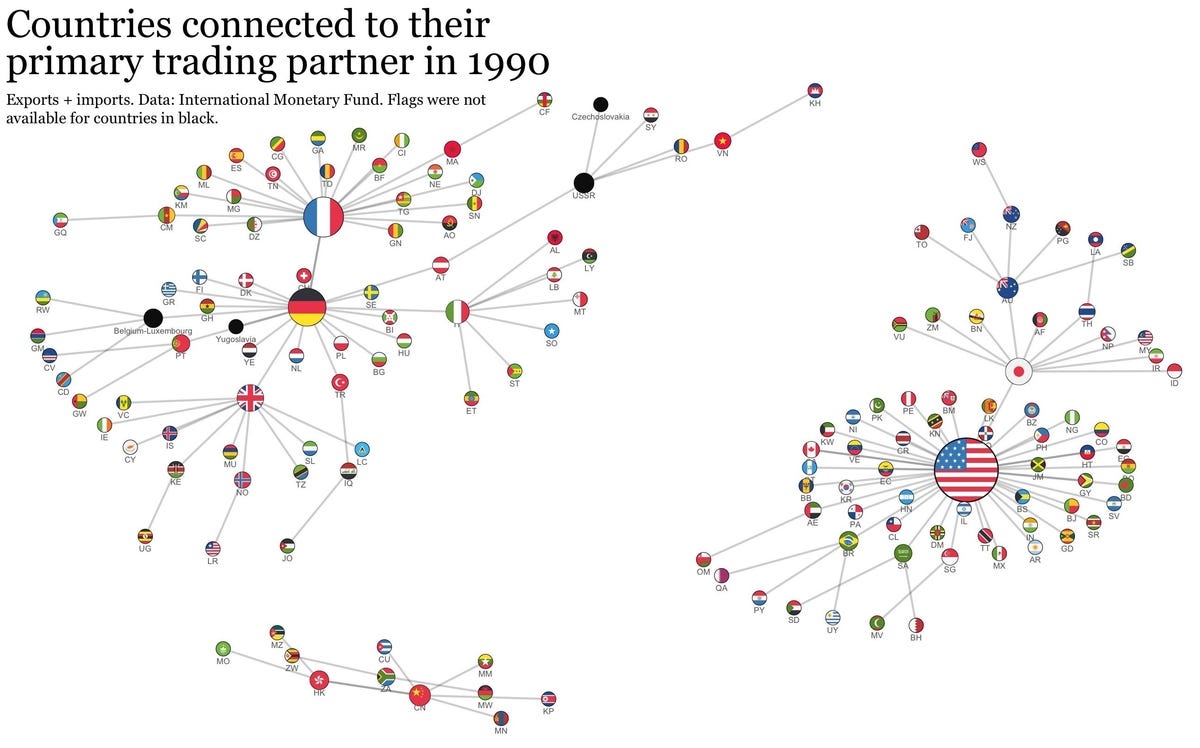

1990 - China’s Rise Begins: By 1990, the landscape began to change significantly. Germany emerged as a European trading hub, driven by its booming automotive sector, while China’s strategic economic reforms under Deng Xiaoping sparked its initial rise, laying the groundwork for future dominance.

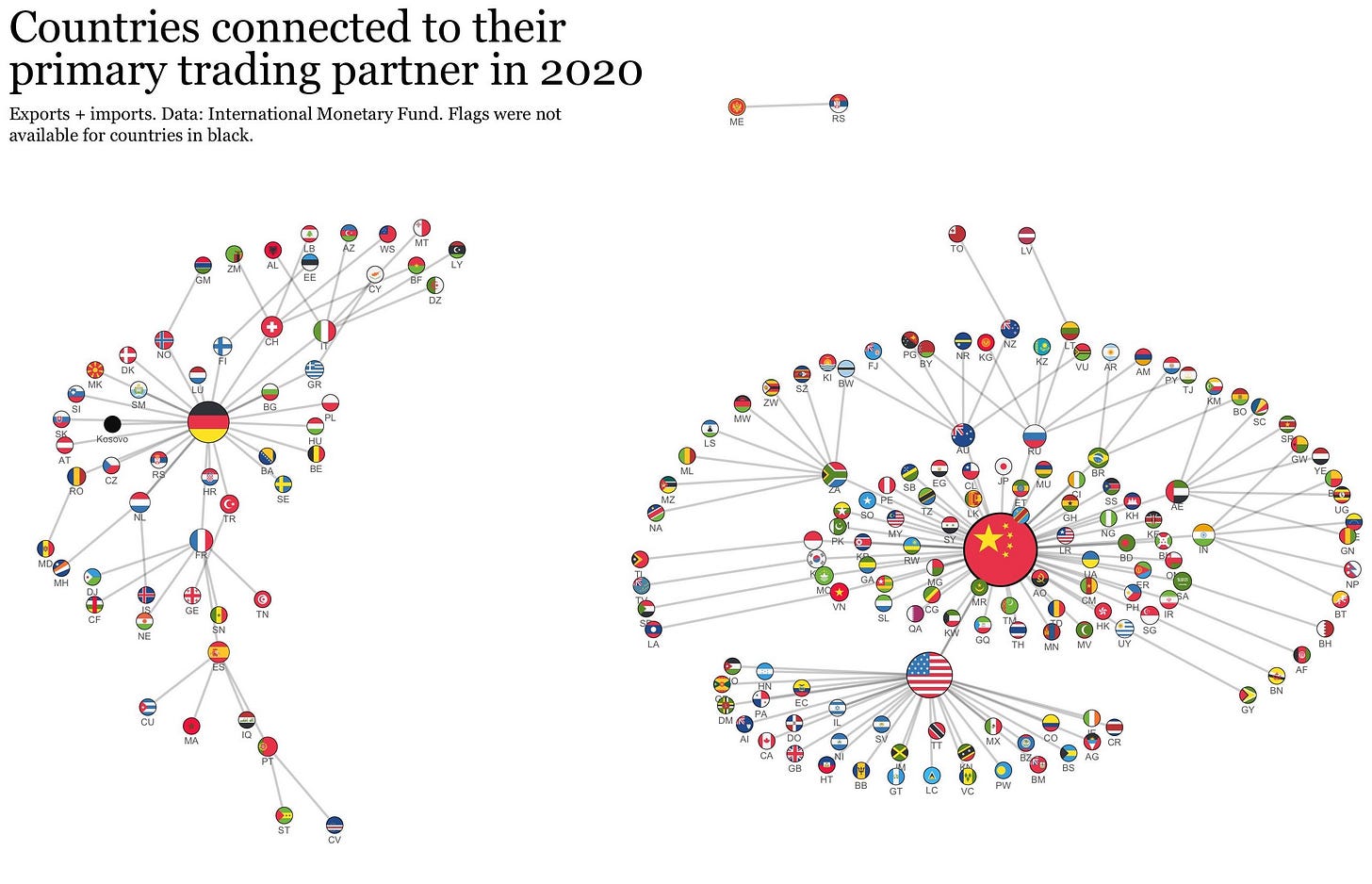

2020 - The New Era—China Takes the Lead: Fast forward to 2020, and China has decisively overtaken the U.S. as the world’s foremost trading partner. This dramatic shift underscores China’s strategic ambitions, setting the stage for the current geopolitical showdown over who will control the defining technologies of the future, notably AI.

Source8

For entrepreneurs and investors, recognizing this shift is essential. The immediate geopolitical drama masks the immense opportunity underneath. Every past Kondratieff wave gave rise to new giants, defined new winners, and reshuffled the global economic hierarchy. AI’s wave promises to be no different, creating enormous opportunities for visionary entrepreneurs ready to act boldly and strategically.

Now is precisely the moment for startups to leverage their agility and innovation. These geopolitical disruptions underscore the urgent demand for decentralized and resilient solutions - exactly what startups can uniquely provide. Whether it’s reshaping supply chains, advancing localized production, or developing groundbreaking AI-driven solutions, the potential for transformative innovation is massive.

Investors and entrepreneurs must think beyond immediate challenges and seize the once-in-a-lifetime chance unfolding today. The companies born in this turmoil are likely to be tomorrow’s titans, driving a future shaped profoundly by AI.

Last but not least: Our friend, the self-declared global leader in regulating AI - the EU - isn’t even on the playing field. The choice is simple and stark: Team USA or Team China? There’s no neutral ground when it comes to shaping the future.

Don’t underestimate this shift. History teaches us that each supercycle rewrites the rules of global leadership. AI will do the same, making this an unprecedented moment of entrepreneurial opportunity. The future belongs to those who dare to seize it right now.

That’s it. I made it shorter this time. Nevertheless, you made it this far - clearly you have strong opinions. Don’t just sit there. Drop a comment below or email me directly: fabian@studioalpha.capital.

Let’s shape the future together.

Fab ⛑️

Sources

https://www.reuters.com/technology/artificial-intelligence/nvidia-says-working-with-partners-make-ai-supercomputers-us-2025-04-14/

https://blogs.nvidia.com/blog/nvidia-manufacture-american-made-ai-supercomputers-us/;

https://www.reuters.com/technology/nvidia-expects-up-55-billion-charge-first-quarter-2025-04-15/?utm_source=chatgpt.com

https://ycharts.com/companies/LVMHF/pe_ratio?utm_source=chatgpt.com; https://www.bloomberg.com/news/articles/2025-04-15/hermes-market-value-surpasses-lvmh-which-once-tried-to-buy-it

https://www.theguardian.com/world/2025/jan/29/eu-launches-simplification-agenda-in-effort-to-keep-up-with-us-and-china?utm_source=chatgpt.com; https://unefemme.net/updated-silk-scarves.html

https://www.jpmorganchase.com/content/dam/jpmc/jpmorgan-chase-and-co/investor-relations/documents/ceo-letter-to-shareholders-2024.pdf

https://en.wikipedia.org/wiki/Kondratiev_wave#:~:text=future%20fourth%20cycle.-,Characteristics%20of%20the%20cycle,collapse)%20between%20expansion%20and%20stagnation.

https://www.visualcapitalist.com/cp/biggest-trade-partner-of-each-country-1960-2020/