⛈️ Turbulences in the Private Markets

What Startups Need to Know About the Current Volatile Markets of Private Investing

Welcome to Roll-Right-In/Money, your go-to source for the latest financial market updates and insights, presented by Tim, Max, and Fabian from Oceanic.us Partners and StudioAlpha.capital. Whether you're a startup founder, an investor, or simply curious about the world of finance, our mission is to keep you informed and provide expert analysis on the issues that matter most … as simple as possible.

In this week's blog, we take a closer look at the private markets, with actionable insights and strategies for navigating this rapidly evolving landscape.

This blog is a 6-min read.

What happened? - Last two week we covered the macro backdrop as a general intro for Roll-Right-In MONEY. Compare “Perfect Storm Part I and Part II”

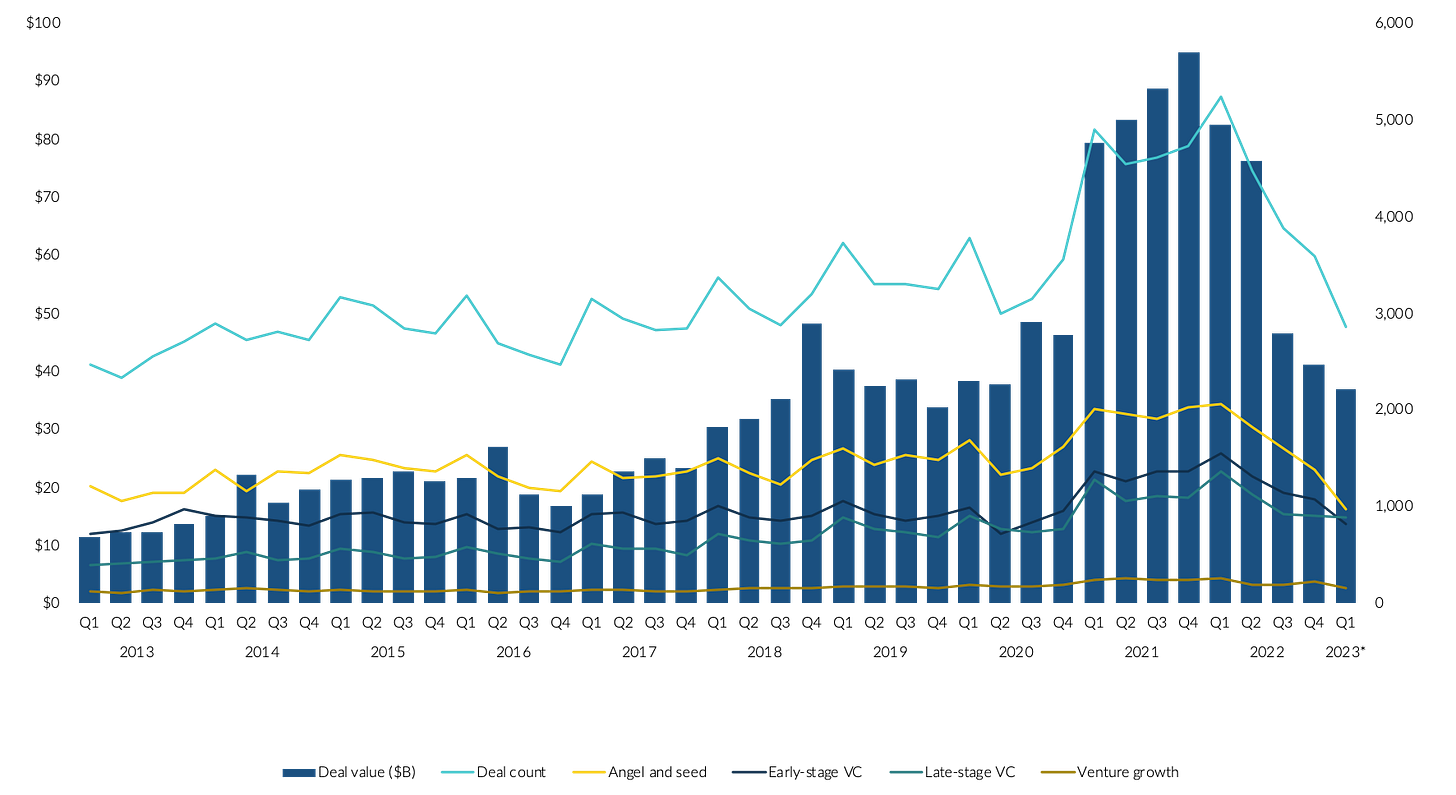

Alright, get started: Private markets were on fire over the last ten years, and we can look at how much money venture capitalists (VCs) spent as a way to measure it. A bunch of reasons made this happen, like:

super low interest rates

never-ending money printing, and …

a rocking stock market.

Big-time money managers like countries' funds, university endowments, and pension plans found themselves with lots of cash, and they started putting more of it into alternative investments, like VCs. VCs then kept raising more and more money each year since the big financial crisis. Things were growing nicely, but it wasn't until 2021 when stuff really started to pop off 🍾

Pic: Quarterly US VC Funding 2013-2023 (Data: Bloomberg)

Private companies were growing and becoming more popular: That's a big deal. Even though there was so much growth, the number of companies going public through IPOs didn't go wild, as you can see in the following chart. Sure, there were some huge IPOs like Facebook, but in general, the IPO party wasn't in full swing between the big financial crisis and the pandemic. Thanks to the booming VC-backed world, private companies got older and larger. Big names like Uber and Airbnb caught everyone's attention while they were still private, along with many other familiar companies.

Pic: Quarterly VC exits (Data: PitchBook)

Pic: Ad powered by StudioAlpha

The rise of private financial markets: As companies chose to stay private for longer and started becoming big players on their own, something we can call the "mega money wave" popped up in the private VC world. The more these big waves happened, the more people started to notice. This gave the private markets some serious street cred.

These mega money waves are like a cool bridge to the public markets. These super big and often late-stage investments started to link up with the public market squad, and they helped boost the whole VC scene.

Pic: U.S. Venture capital funding by round size (Data: CBInsights)

Bananas: When everything went crazy right after the pandemic in 2021, it sent the private markets into a state of wild partying. We were at the top of the roller coaster, with investing being driven by the hottest gossip. VC money poured in like a busted fire hydrant, company values went kaboom, and loads of newbies jumped into the VC game. Companies raked in so much new money that many started splurging and hired more people than a rock band 🤘🏽 has roadies.

Pic: TTM price-to-sales multiple of VC-backed IPO index (Data: Pitchbook)

Get rich 🤑: It's also super key to remember that the "exit door" (when companies go public or get bought out) was swinging like crazy and companies were rushing through it at a wild speed. IPOs and SPACs (a fancy way to go public) blew up bigger than a popcorn machine. The IPO/SPAC door wasn't just open, it was off its hinges! The companies that went through it were doing great, and that gave a turbo boost to the later stage part of the private market, and the whole market got a lift as well.

Pic: VC- versus PE-backed versus DeSPAC IPO index (Data: Pitchbook)

Party is over 🤢: When everything came tumbling down, it was like the end of an epic fireworks show. A few things happened: the group of companies used for comparison pretty much lost all their "oohs" and "ahhs," interest rates took off like a scared cat, company values dropped like a hot potato, and the exit doors (like IPOs and buyouts) slammed shut quicker than the bar doors at last call.

Pic: TTM price-to-sales comparisons (Data: Pitchbook)

Those mega money waves, that were popping up everywhere in the past years and totally went wild in 2021, suddenly dropped sharply.

Pic: Mega-round financing (data: Crunchbase)

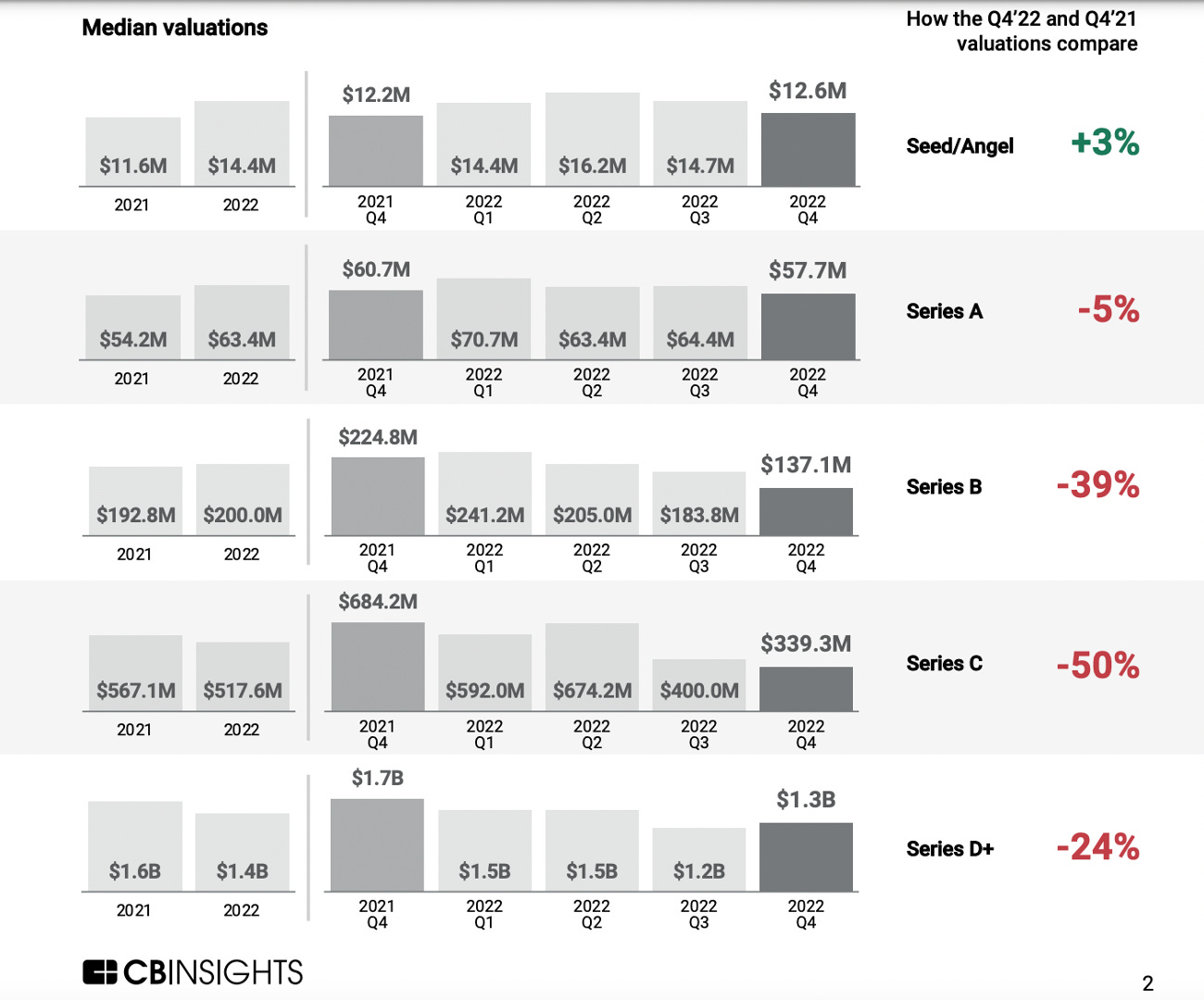

Dry powder not getting called: VCs found themselves smack dab in the middle of this mess. And even though they still had a ton of cash ready to roll (or "dry powder" as they like to call it), the VC funding scene slowed down faster than traffic on a Friday afternoon. Even though the value of first-time funding rounds took its sweet time to drop, they're finally getting with the program and adjusting across the board.

Pic: How the Q4’22 and Q4’21 valuations compare (Data: CBInsights)

Bumpy ride: So, what we've seen is that the private markets are still in the middle of a huge shake-up. For a lot of companies, it's going to be a bumpy ride. Those that used to find it easy to get money are now seeing the end of their cash and might not find more waiting for them. We could be at the start of a time where a lot of private companies fold, merge, or have to let people go.

Now, there's still a lot of money in the VC world, something like $290+ billion. But it might not be given out on the terms or values that company founders are used to. Not all companies will get a lifeline. VCs will probably back the sure bets and end up with fewer, but stronger, companies in their portfolios.

Is there any room for hope or advice for people starting companies? - Absolutely. Companies that make it through this shake-up are likely to be strong. And while it might feel like the end of the world, even if the total money invested in 2023 is only 40-50% of what it was in 2022, that's still around the same amount we saw in healthy years like 2017/18. The focus now should be on providing value and creating sustainable business models. The companies that manage to do this will likely be strong, while others might fall by the wayside.

Bottom line: For those just starting out, it's important to understand that while there is money out there, the bar to get it is going to be higher and the competition fiercer. It's a good idea to really understand what investors are looking for in this climate and focus on key assets like people and networks.For founders of companies that are making money, it's going to be an adjustment. They'll need to be ready to look hard at their business model and be ready to make it leaner if needed. They'll need to think about how fast they can become profitable and how their products really provide value. It's a good idea to test their pricing models and see if they can increase prices without losing a lot of customers.

Ok, that’s it for today. We’ll back next week. Thank you for reading and posting your questions and feedback!

Best,

Max, Tim & Fabian